Benefits of accumulating gold through life insurance

The life insurance market increases its volumes annually by more than 10% and this trend continues. In anticipation of a new draft law on investment insurance (unit-linked), the topic of reserve management becomes even more relevant, according to Beinsure Top Trends in the Global Life Insurance Market.

After all, it is important for the company not only to increase volumes, but also the quality of the entire range of services that it provides.

And, today, reserve management of life insurance companies is an issue that is relevant for two reasons: it characterizes the degree and level of professionalism of the company, reliability and development prospects, and this gives it the opportunity to develop and promote its insurance products.

How insurance companies can manage reserves today is regulated by the insurance legislation of Ukraine (ICs have a rather narrow field for investment), but of those assets that insurers can use, there are a number of interesting ones that can be used quite effectively.

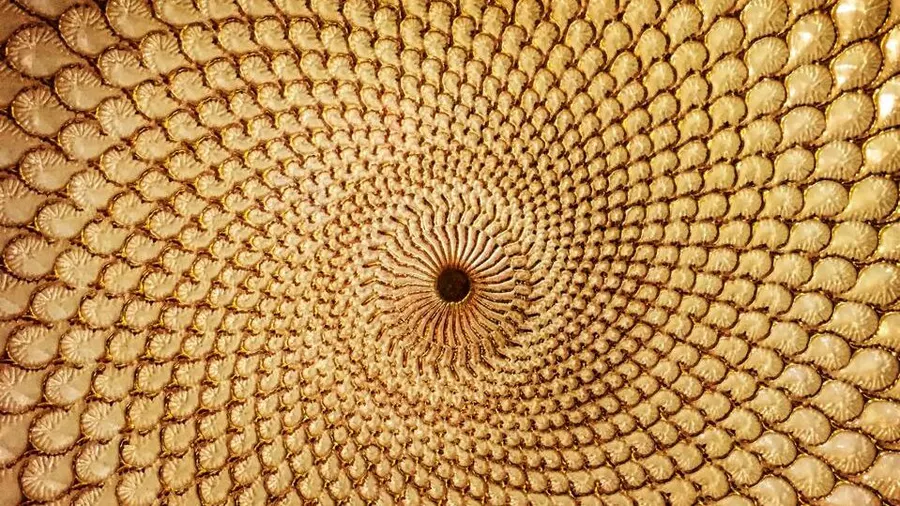

Why exactly gold?

Life insurance is a long-term investment and long-term reserves are created here. And such an asset as gold has the properties of reliability, liquidity, and it is also stable against the backdrop of rising inflation.

If we analyze the change in the price of this metal over the past 8 years, then its value has increased by almost 3 times.

Gold is the asset that allows the client to place his asset for a long time, and understand that in 10-20 years you can get an amount 2-3 times more than from another asset.

Assets that an insurance company can use:

— funds in the current account;

— bank deposits (deposits), foreign currency deposits according to the insurance currency;

— real estate, long-term financing (crediting) of housing construction;

— stocks, bonds, mortgage certificates, government-issued securities;

— banking metals;

— loans to insurers-citizens who have concluded life insurance contracts, within the redemption amount at the time of issuing a loan secured by the redemption amount;

— investments in the economy of Ukraine in the areas established by the Cabinet of Ministers of Ukraine.

Gold is the metal that has benefits for the client. Today, many banks are noticing an increase in demand, and demand is expected to be stable until the end of the year.

As for the accumulation of gold through a life insurance instrument, in fact, by purchasing an accumulative insurance policy, a person can secure the same gold deposit and risk protection.

But there are a number of advantages for the client in the accumulation of gold through the insurance mechanism:

– the client purchases gold at the rate;

— there are no questions about how to store gold;

— there is a cover in case;

— high investment income;

– the client can take advantage of tax benefits and has an additional refund amount

This tool for investing gold through life insurance is one of the most effective tools today, if we consider such an asset for saving your money as gold. And, by including this point in our programs, we effectively manage reserves and give the market those programs that allow us to attract new customers.